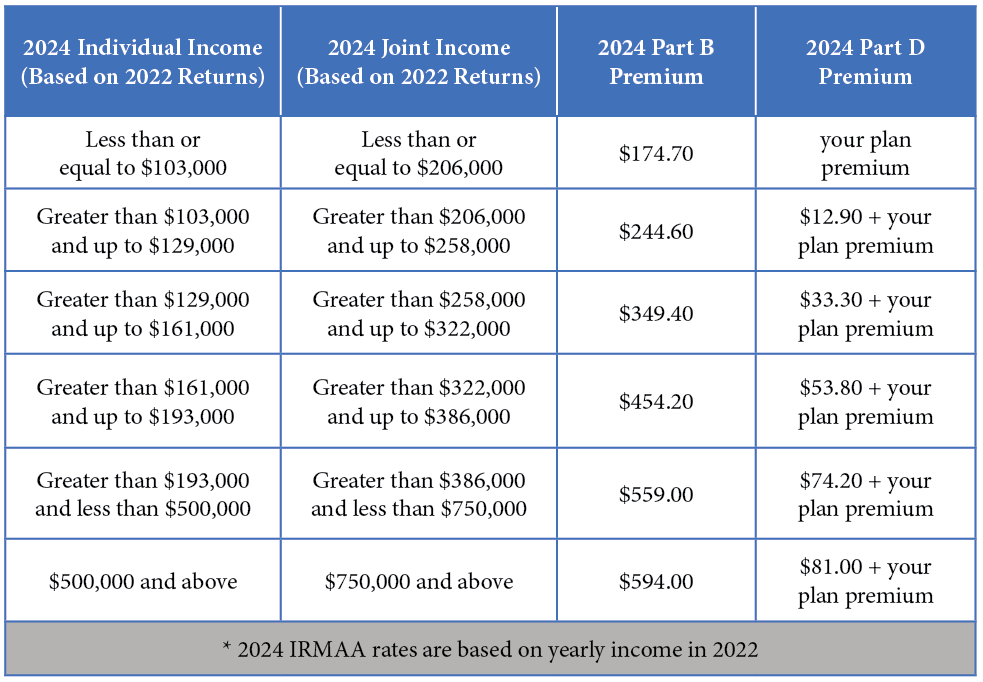

Irmaa Brackets 2025 Married Filing Jointly - What IRMAA bracket estimate are you using for 2025?, If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you: When the internal revenue service (irs) provides us the tax filing status of married filing separately, assume the couple lived together at some point in. The 2025 IRMAA Brackets Social Security Intelligence, Here is how you can learn about the change and how to avoid irmaa. The standard part b premium for 2025 is $174.70.

What IRMAA bracket estimate are you using for 2025?, If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you: When the internal revenue service (irs) provides us the tax filing status of married filing separately, assume the couple lived together at some point in.

GMIA, Inc. 2025 Part B Costs and IRMAA Brackets, The standard part b premium for 2025 is $174.70. Medicare beneficiaries who reported an individual income at or below $103,000 in 2025, or a married couple.

2025 Tax Brackets Announced What’s Different?, Online through your secure medicare account; If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

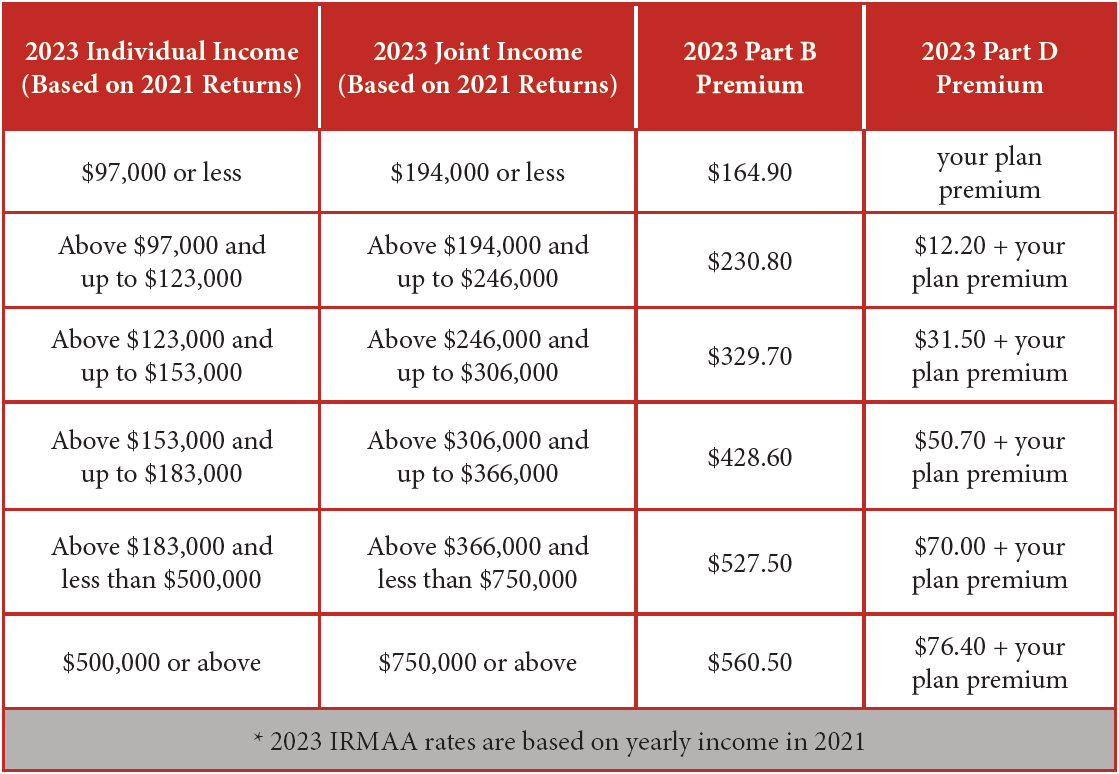

2025 Irmaa Brackets Allyn Benoite, What are the irmaa brackets for 2023 and 2025? Ssa removed the irmaa penalties for 2025.

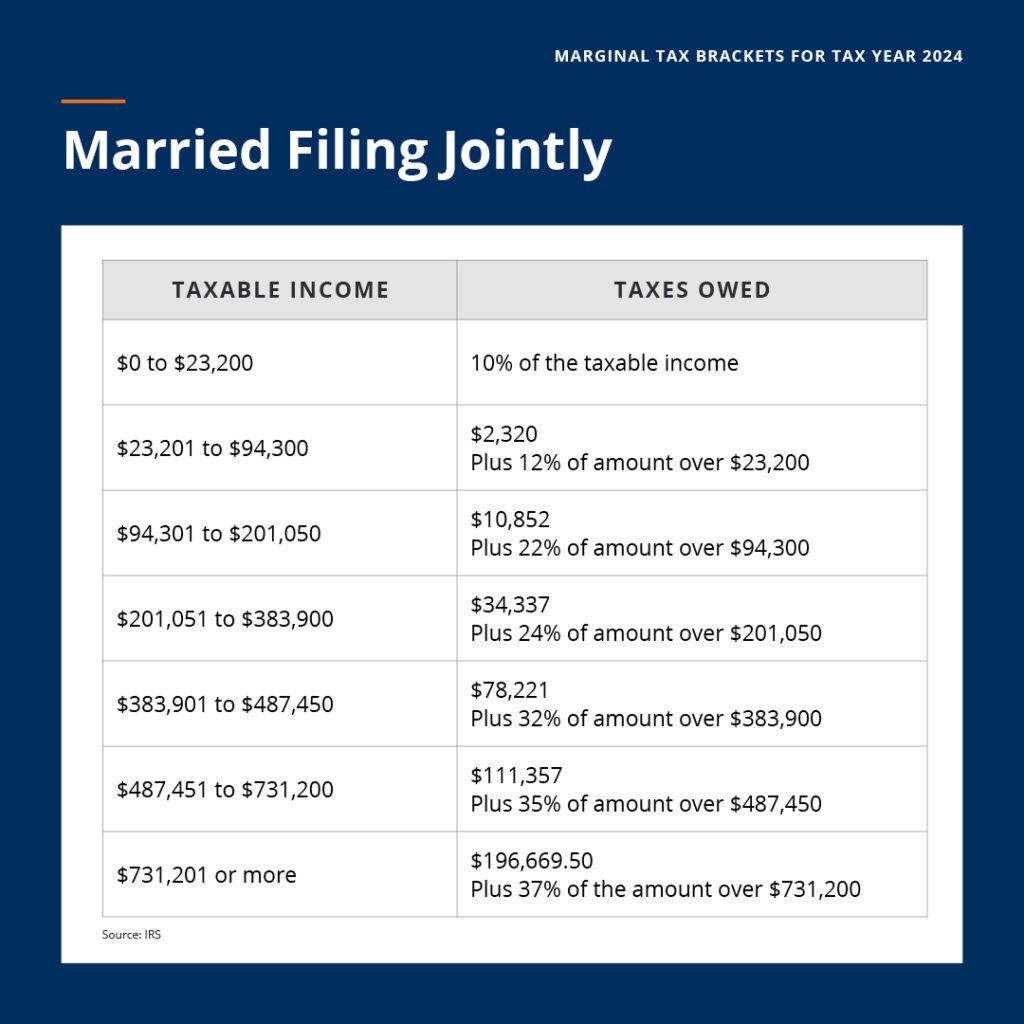

Married filing joint $29,200 keep in mind that if and when you withdraw that money from the ira, the withdrawn amount is 100% subject to income tax at whatever the prevailing.

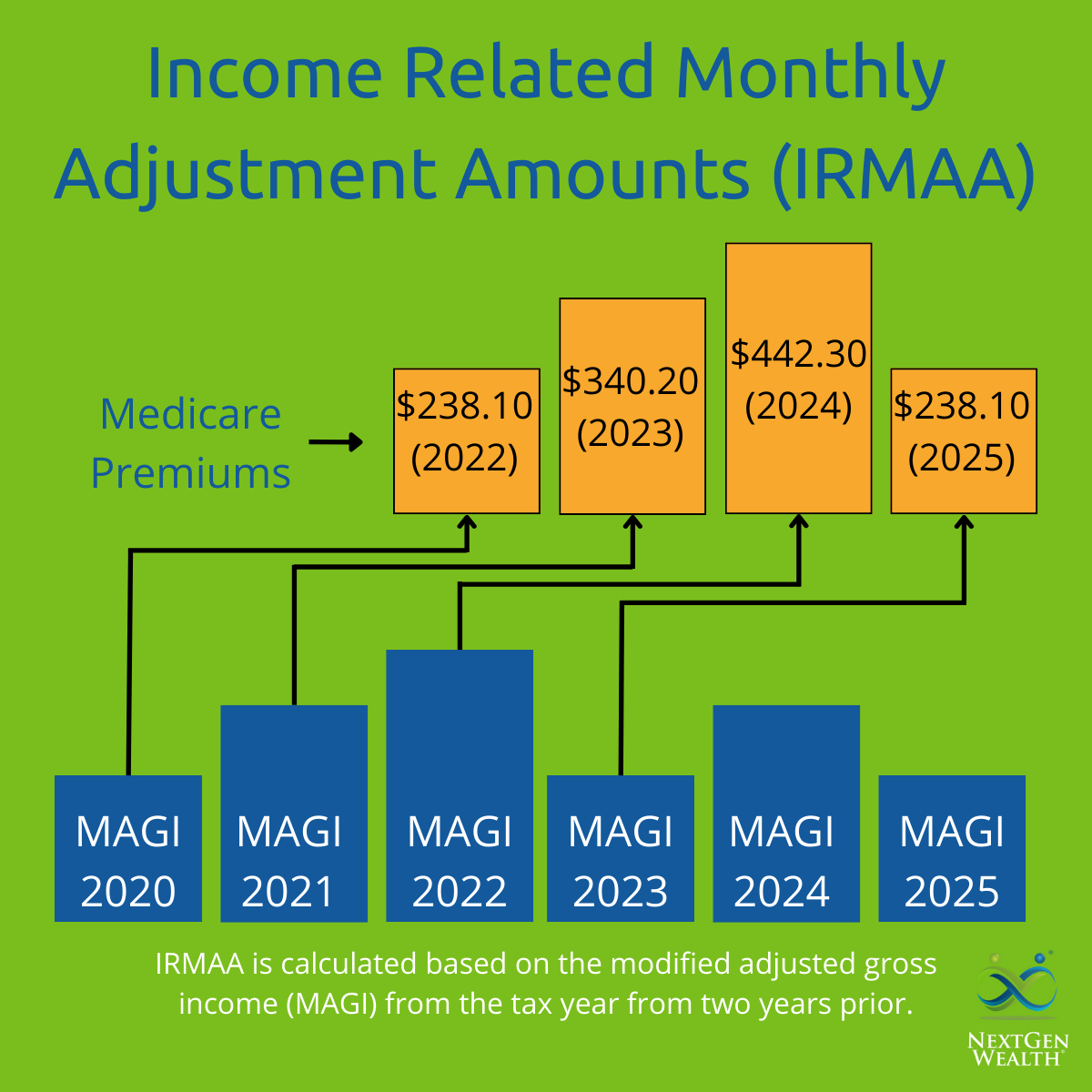

Irmaa Brackets 2025 Married Filing Jointly. If your 2025 magi was over $750,000, your 2025 part b and part d irmaa costs would be from the highest bracket whether you filed married but separate or jointly in 2025. The medicare irmaa is based on the income on your tax return two years prior.

2025 Irmaa Brackets Janel, Married filing joint $29,200 keep in mind that if and when you withdraw that money from the ira, the withdrawn amount is 100% subject to income tax at whatever the prevailing. Irmaa percentage tables, medicare part b premium year 2025 1.

“set of tables containing modified adjusted gross income (magi) ranges and income. The irmaa calculation uses three tax filing options:

2025 Married Filing Jointly Tax Brackets Golda Gloriane, In 2025, with the inflation adjustment to the irmaa brackets, you will no longer have a part d or part b irmaa payment. If your 2025 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

What IRMAA bracket estimate are you using for 2025? (2023), What are the irmaa brackets for 2023 and 2025? The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2025) for a single person and $194,000.

Social Security Irmaa Brackets 2025 Mufi Tabina, Irmaa charges apply to eligible medicare beneficiaries, whether you have original. Social security defines irmaa thresholds as:

The IRMAA Brackets for 2025 Social Security Genius, Most other medicare part d beneficiaries earning over. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you: